Refinancing a home loan can be a good idea if you want to lower your monthly payment or reduce your interest rate. It can also help you avoid foreclosure by offering you a shorter-term loan. If you are considering refinancing your loan, make sure to consider your options carefully and compare rates.

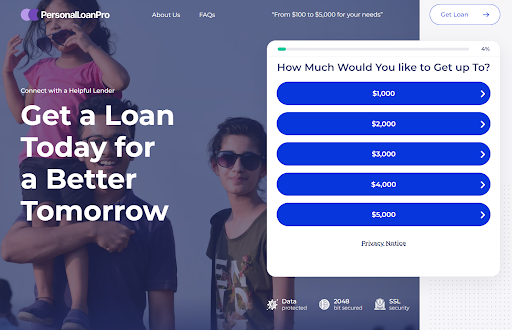

There are many things to consider before applying for a personal loan. One of the biggest things to consider is the interest rate. You want to find a low interest rate, but make sure you can afford the monthly payments. Make sure to shop around to find the best loan for your needs. Many lenders have a simple calculator that you can use to see how much you can borrow.

When applying for a personal loan, you should also collect all of your supporting documentation, such as proof of employment, income, and residence. Another important factor is your credit score. Although personal loans are often considered to be a good way to borrow money, you should first check whether you can get the money you need from other sources.

For example, you may be able to borrow from the equity in your home or put the expense on a credit card. Personal loans generally require a lot of documentation, so be prepared to supply it. Some lenders require that you provide proof of your identity and income, including pay stubs, W-2s, and bank statements. They also may require you to provide tax returns if you’re self-employed.

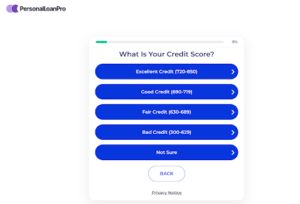

Credit Score impact

If you’re worried about your credit score, you should consider paying off your debt and improving your credit score before applying for a personal loan. You should also consider whether you can afford the monthly payments for the personal loan and whether you can afford to save money for other financial goals instead.

To see how much you can afford to borrow, you can use a short-term loan calculator at LendingTree to see how much you can expect to pay on the loan each month. It’s important to remember that these calculations do not include other costs, such as credit card fees or application fees.

Once you know what you need, you can start your search for the right loan. Make sure that you have a clean credit history and that your debt to income ratio is manageable. The lender wants to see that you’re able to make your repayments on time. Having a history of making on time payments will increase your chances of getting approved for a personal loan.

Reduce your monthly payment

A lower monthly payment can lower the overall expense of your loan. Lowering the interest rate and lengthening the loan term are two ways to reduce your payment. However, reducing the interest rate can also lead to higher monthly payments in the future. You may benefit from extending the loan term, but you should consider the costs of refinancing and the refinancing fees.

In addition to lowering the monthly payment, refinancing your loan can also enable you to make other changes to your loan. For example, go to the following link: refinansiere.net/refinansiering-av-forbrukslån/ and you might be able to learn more about how to switch to a fixed-rate mortgage or borrow from your home equity. Before you decide to refinance your loan, talk with your lender to find out what your options are.

Another option is to make a lump-sum payment. This option will not alter your monthly payments, but it will help you pay off the loan sooner. You can also ask your lender to recast your loan, which means that it will recalculate your payments based on a smaller principal balance.

Lower your interest rate

One of the main reasons to refinance a loan is to lower the interest rate. This can save you hundreds of dollars over the life of the loan. In addition, you can adjust the terms of your loan and tap into the equity of your home. While refinancing has its advantages, it also comes with costs and risks. Refinancing fees can add up and can make it difficult to recoup the costs of the refinancing process.

In an example, assume you have a $200,000 30-year fixed-rate mortgage, and you have to pay $2,500 in refinancing fees at closing. Refinancing benefits may not become apparent for a year or two, or even three years after the initial refinance. Therefore, it’s important to factor in total interest payments when evaluating the benefits and costs of refinancing.

Avoid foreclosure

If you are struggling with a high mortgage payment and are looking to avoid foreclosure, refinancing may be the right choice for you. Refinancing offers many benefits, but you should remember that you must be willing to accept some risks. Foreclosure is a horrible experience, and losing your home can change your life for the worse. There are several different methods you can use to avoid foreclosure, including a reverse mortgage and short sales.

One of the best ways to avoid foreclosure when refinancing a loan is to consider a short sale, a deed-in-lieu-of-foreclosure agreement, or a deed in lieu of foreclosure. These options are beneficial for the buyer, seller, and lender, as it allows the buyer to save their credit rating, get out of the mortgage and buy a new home, and avoid the costs of foreclosure.

You can also try to work with your lender before foreclosure proceedings start. If you’re having difficulty making your monthly payments, contact your mortgage lender right away and ask if there are any options available to help you stay in your home. If you’re able to prove to the lender that you’re acting in good faith, they may be willing to work with you.

Another way to avoid foreclosure is to avoid defaulting on your loan. In some cases, it is not possible to avoid foreclosure. Foreclosure can result in severe financial consequences for the homeowner, and they may not be able to sell their home. Often, a deed in lieu of foreclosure offers the homeowner a second chance.

Get a shorter-term loan

Refinancing your loan for a shorter term can help you build equity faster. It’s especially useful for homeowners who have high interest rates and have not refinanced in 6 months. Shorter loans also allow you to pay off expensive items sooner. You can use this extra money for college savings, the next car purchase, or retirement. However, you should make sure the new payment will not break your budget.

When refinancing a loan, it’s important to understand your options. The best choice will depend on your current financial situation and goals. According to this study, a longer loan term will cost more interest in the long run. A shorter-term loan can allow you to pay off your debt more quickly, but it can affect your monthly payment and the goals of your loan.

Before refinancing a loan, make sure you compare terms between different lenders. If you find a better deal than the one you’re currently in, you can save money in the long run. However, refinancing a loan may come with closing costs, including origination fees, appraisal fees, title insurance fees, and credit reports.

These fees can add up to 2% to 6% of the loan amount. You should calculate the break-even point, which is when the savings from a lower interest rate will outweigh the costs of the refinancing. To calculate the break-even point, divide the savings you’ll make from the new payment by the amount of closing costs.

When refinancing a loan, it’s a good idea to opt for a shorter-term loan. Shorter-term loans usually have lower monthly payments and lower interest rates, which can save you a lot of money over the life of the loan. Besides, you can save up to a full percentage point of interest if you refinance your loan for a shorter term.

Avoid taking on new credit

If you’re planning to refinance a home loan, one of the most important things you can do to boost your credit score is to avoid taking on new credit. While it may boost your score by lowering your credit utilization and the age of your accounts, it can also hurt your score. Each new application will subtract a few points, and many applications within a short period of time can add up to significant damage.

Refinancing a loan can lower your debt, but it can also lower your monthly payment, which lenders like to see. Although you’ll experience a small drop in your credit score, it can bounce back within a few months. But remember that you’ll be opening a new account, so be sure to review the details carefully before making any large, life-altering decisions.

Always compare the terms and costs of the new loan to the old one. Despite the fact that the interest rate on a refinancing loan is usually lower, you’re still taking on new credit and need to compare the terms of your new loan to those of your previous one. You can get an idea of how much you’ll save by comparing the two.

Check your credit score before applying for a refinance

Before applying for a refinance loan, it’s important to check your credit score. Lenders use tiers or bands to determine your credit score. For example, a good credit score is 700 or higher, but you don’t need to reach this level in order to qualify for a better rate. But you can always try to improve your score in order to get a lower rate.

Your credit score depends on the number and quality of your payment history. If you’ve missed multiple payments, it will affect your credit score. Fortunately, there are ways to avoid missing payments. For instance, setting up a recurring reminder for yourself to pay your mortgage each month will help you stay on top of your payments.

A low credit score can cause increased interest rates and make refinancing difficult. However, it’s possible to strengthen your refinancing application by finding a co-signer who is willing to take on financial responsibility for the loan. Your co-signer will need to have a low DTI ratio and a good credit score and, if not, try applying for a VA loan refinance or a USDA refinance loan.

Technology2 years ago

Technology2 years ago

blog2 years ago

blog2 years ago

Startups2 years ago

Startups2 years ago

blog2 years ago

blog2 years ago

blog2 years ago

blog2 years ago

blog2 years ago

blog2 years ago

blog2 years ago

blog2 years ago

blog2 years ago

blog2 years ago