Finance

How to Find A Quick Title Loan Near Me?

Published

2 years agoon

By

Ethan More

It is always said that your assets will help you in the hour of need. It is true that whenever you are in an emergency and want money immediately then title loans are an amazing option. You are not required to sell your favorite car or an antique piece just because of title loans.

Title loans allow you to get the desired amount of money immediately just by putting your asset as collateral. When you repay the loan amount your asset will be provided to you without any damage. It is a respectable way of getting money without affecting your self-esteem.

Different platforms allow you to get quick title loans. You can also get help from the broker services that connect you with the lenders of your choice. Let’s just know more about title loans, how to get them, and from where we can try.

Can I Get A Quick Title Loan?

Title Loans are not famous hence people are always confused about whether they are eligible to get the title loan or not. Mila Garcia, co-founder of iPaydayLoans confirms that you can get a quick title loan if you have the following eligibilities:

- Stable Income Source: You can easily get a title loan if you have a stable source of income. It is a sign of confirmation that the borrower can return the loan at the given time.

- Verified ID: It is important to have an officially verified ID. It is proof that the borrower is above 18 and a resident of a specific state.

- Insurance Documents: Insurance documents of the asset are also essential. It is a security to the lender that the money is not going to waste in any condition.

- No Insolvency: If the borrower is bankrupt while applying for a title loan then the lender will not provide any loan. Bankruptcy is the major disqualification for a borrower.

- Clear Transaction Documents: The asset that you are using as collateral must be yours in the documentation. You cannot use someone else’s property to get a loan.

iPaydayLoan – Find A Quick Loan Provider

iPaydayLoans works as a broker service to connect valuable borrowers with reasonable lenders. You would find a complete wide range of variety in the availability of lenders in the connections of iPaydayLoans. iPaydayLoans is a credible platform hence you don’t need to worry about your credential information.

Not only this, all the lenders are authentic and secure hence there would be no chance of indulging in a scam. You can get the answer of title loans near me to get money as quickly as on the same day without any restriction. Most of the title loan providers determine the amount of the loan according to the asset.

iPaydayLoans allows you to get a loan between $50 to $5,000 according to your demand and situation. If you just consider the best things available in iPaydayLoans broker services then the top of the list must be its quick working. The money would be funded to the account of the borrower after approval from the lender.

A title loan is the most recommended type of loan for borrowers on the platform of iPaydayLoans. If you are a person who has a bad credit score even though iPaydayLoans never ignores you. You can enjoy all the broker services on this platform just like the other customers with high credit scores. Even if you have a zero credit score you can find a lender for you here.

How To Find A Quick Title Loan?

When it comes to finding a loan provider for a title loan most people prefer the lenders around their locality. It becomes difficult to carry your asset from one place to another just to get a loan. iPaydayLoans is an amazing platform that allows you to get a title loan provider through online working. The procedure you need to follow is explained here:

Step 1: Fill out An Application

The first thing you need to do is to fill out an application form with your personal and financial information. The information is collected for the lender.

Step 2: Get Approval

All the lenders present in the network of iPaydayLoans will review your application and verify the information. The lender will approve your loan application if he/she is satisfied and offer you terms and conditions.

Step 3: Get Funded

When a borrower accepts the terms and conditions of the lender the money would be directly funded to the borrower account.

It is important to keep in mind that when both the borrower and a lender are satisfied with one another’s terms and conditions. The second step is to have an e-signing agreement between both parties for financial safety.

What Do We Get From iPaydayLoan?

iPaydayLoans is a recommended type of platform to get in touch with the desired lender. You can enjoy a simple interface, free-of-cost guidelines, and many other features in one place. Let’s know more about iPaydayLoans that make it prominent in the present world public:

-

Transparency

Most people want to have transparency in the procedure while getting a loan from a lender. iPaydayLoans works on its procedure and confirms that there are no hidden charges from the side of the borrower for any lender on the list.

-

Flexibility

iPaydayLoans provides a marvelous opportunity as you can enjoy flexibility in working. You can fill out the application form online and get the approval at your home. Everything would be done at your doorsteps without any disturbance.

-

Small Installment

Sometimes it becomes difficult for a person to return the loan money at once. In this way, you can easily make the installments of your loan on a monthly or quarterly basis according to your feasibility. The money would be returned to the lender in small chunks.

-

Quick Funding

In the hour of need, we need money on an immediate basis that is completely fulfilled by iPaydayLoans. The money would be transferred to the account of the borrower exactly after the confirmation from the lender without any delay or paperwork.

-

Easy Process

You are not required to move from one lender to another to get a title loan through iPaydayLoans. Now you just need to follow the above-mentioned three simple steps and the money would be transferred to your account easily without any professionalism.

Sum up

Assets always help us to get out of uncalled emergencies. Now you don’t need to sell your favorite car, rather you can get a title loan. When you return the loan the car would be provided to you. iPaydayLoans is an amazing platform to get help in taking title loans with quick procedures and trustworthy lenders. The platform connects you with lenders without any restriction or delay.

Finance

How To Buy NCD: A Step-by-Step Guide

Published

3 months agoon

August 15, 2024By

Ethan More

Understanding NCDs

Non-Convertible Debentures (NCDs) are fixed-income instruments issued by corporations to raise capital. Unlike convertible debentures, NCDs cannot be converted into equity shares of the issuing company. Investors who purchase NCDs receive regular interest payments at a fixed rate until the maturity date, when the principal amount is repaid.

NCDs offer investors a stable source of income and are typically less volatile compared to other investment options like stocks. They are graded based on the creditworthiness of the issuer, with higher-rated NCDs offering lower interest rates but greater security. Understanding the different types of NCDs available and their associated risks is crucial for investors looking to diversify their investment portfolio and generate steady returns.

Types of NCDs Available

Non-convertible debentures (NCDs) are a popular form of investment that offer fixed returns over a specific period. These NCDs do not provide the option to convert the debentures into equity shares of the issuing company. They are a suitable choice for investors seeking fixed income and capital protection.

On the other hand, convertible debentures allow investors the option to convert their debentures into equity shares of the issuing company at a predetermined ratio and price. These NCDs offer potential capital appreciation along with the regular fixed interest income. Investors looking to benefit from both fixed returns and potential equity upside may find convertible debentures an attractive investment option.

When it comes to option trading strategy, investors have various choices to consider. Non-convertible debentures (NCDs) offer fixed returns over a specific period without the option to convert into equity shares, making them a suitable option for those seeking fixed income and capital protection. On the other hand, convertible debentures provide investors with the option to convert their debentures into equity shares, offering potential capital appreciation along with fixed interest income. For investors looking to benefit from both fixed returns and potential equity upside, convertible debentures present an attractive investment option. If you are interested in exploring different investment strategies, consider incorporating an option trading strategy into your portfolio management approach.

Researching NCD Issuers

When researching NCD issuers, it is crucial to delve into the company’s financial standing, market reputation, and future growth prospects. A thorough examination of the issuer’s balance sheet, income statement, and cash flow statement can provide valuable insights into its financial health and sustainability.

Furthermore, assessing the issuer’s management team, corporate governance practices, and industry positioning is essential in determining the company’s ability to honor its NCD obligations. Understanding the competitive landscape and potential risks that may impact the issuer’s business operations can help investors make informed decisions when considering investing in their NCDs.

Evaluating NCD Ratings

Evaluating NCD ratings can be a crucial step in making informed investment decisions. Ratings provided by credit rating agencies offer insight into the creditworthiness and risk associated with a particular NCD issuer. Investors should pay close attention to these ratings as they indicate the likelihood of timely repayment of interest and principal.

When evaluating NCD ratings, consider factors such as the reputation and methodology of the rating agency, the issuer’s financial performance and stability, industry trends, and macroeconomic factors. A higher credit rating signifies lower credit risk, while a lower rating suggests higher risk and potentially higher returns. Therefore, understanding NCD ratings and their implications is essential for investors looking to build a diversified and balanced investment portfolio.

Analyzing NCD Terms and Conditions

When analyzing the terms and conditions of Non-Convertible Debentures (NCDs), it is crucial to pay close attention to the interest rate offered. Different NCDs come with varying interest rates, usually fixed or floating. Understanding the interest rate structure will help investors assess whether the NCD fits their investment goals and risk tolerance.

Additionally, investors should carefully review the repayment terms of NCDs. This includes the maturity period and redemption options available. Some NCDs come with call or put options that may affect the investor’s potential returns and exit strategy. Evaluating the repayment terms of NCDs will provide clarity on when and how the investment can be redeemed, allowing investors to make informed decisions.

Calculating Potential Returns

To calculate the potential returns from investing in Non-Convertible Debentures (NCDs), investors need to consider various aspects. One crucial factor is the coupon rate offered by the NCD issuer. This fixed interest rate determines the regular income investors can expect to receive from their investment over the tenor of the NCD.

Additionally, investors should pay attention to the current market conditions and the credit rating of the NCD issuer. A higher credit rating indicates lower risk, but it may also come with a lower coupon rate. By factoring in these elements, investors can make informed decisions about the potential returns from investing in NCDs.

Demat App is a convenient tool for investors looking to manage their investment portfolio efficiently. With Demat App, investors can easily buy, sell, and track their securities in electronic form. By using Demat App, investors can eliminate the hassle of physical share certificates and enjoy seamless transactions in the stock market. Whether you are a seasoned investor or just starting out, Demat App provides a user-friendly interface and real-time updates to help you make informed investment decisions. Download Demat App today and take control of your investment journey.

Opening a Demat Account

When it comes to investing in Non-Convertible Debentures (NCDs), one of the primary requirements is to have a Demat account. A Demat account, short for dematerialized account, is an electronic account that holds all your investment securities in a digital format. To open a Demat account, you can approach any registered Depository Participant (DP) such as banks, financial institutions, or brokerage firms. They will guide you through the account opening process, which involves filling out an account opening form, providing Know Your Customer (KYC) details, and submitting necessary documents like PAN card, Aadhaar card, address proof, and passport-size photographs.

After submitting the required documents and completing the formalities, your Depository Participant (DP) will verify the details provided. Once the verification is done, you will be provided with a unique Demat account number which you can use to start investing in various financial instruments, including NCDs. It is essential to choose a reliable DP with a good track record to ensure the safety and security of your investments. Keep in mind that most DPs also offer online access to your Demat account, making it convenient for you to monitor your investments and execute transactions from the comfort of your home.

Purchasing NCDs Online

When it comes to purchasing NCDs online, investors have the convenience of accessing a wide range of issuers and offerings through various platforms. One of the key benefits of purchasing NCDs online is the ease of comparison shopping, allowing investors to review different NCD options in terms of interest rates, tenures, and issuer credibility before making a decision. Additionally, online platforms often provide detailed information about each NCD, allowing investors to conduct thorough research and due diligence before investing.

Another advantage of purchasing NCDs online is the streamlined process of application and allocation. Investors can easily fill out applications, submit required documents, and receive updates on the status of their investments online. This not only saves time but also reduces the paperwork traditionally associated with investing in NCDs. Moreover, online platforms often offer a seamless payment process, allowing investors to conveniently transfer funds and finalize their NCD purchases with just a few clicks.

Monitoring NCD Performance

Monitoring NCD performance is key to ensuring that your investment continues to meet your financial goals. Regularly tracking the performance of your NCDs allows you to stay informed about any changes in their value and interest payments. This monitoring process also helps you assess the overall health of the issuer and the stability of your investment.

By keeping a close eye on the performance of your NCDs, you can proactively respond to any fluctuations in the market and make informed decisions about whether to hold, sell, or reinvest in them. Monitoring factors such as interest rates, credit ratings, and the financial health of the issuer will enable you to stay ahead of any potential risks and maximize the returns on your investment.

Selling NCDs if Necessary

When the time comes to sell your Non-Convertible Debentures (NCDs), it’s essential to navigate the process with care and consideration. Selling NCDs may be necessary for various reasons, such as requiring funds for other investments or financial goals. Before proceeding with the sale, it’s crucial to assess the current market conditions and the performance of the NCD issuer to make an informed decision.

When selling NCDs, investors should consider factors such as the prevailing interest rates, the issuer’s creditworthiness, and the terms of the NCDs. Timing plays a key role in getting the best possible returns, so monitoring market trends and economic indicators can help determine the optimal moment to sell. Additionally, understanding any penalties or charges associated with early redemption is vital to avoid any unforeseen costs.

Finance

Hot Forex (HF Markets) Review 2022: Pros and Cons

Published

2 years agoon

December 8, 2022By

Ethan More

The HF Markets Group’s broker HFM provides a wide range of account types, the best selection of trading assets, and top-notch software. Additionally, HFM offers favorable trading conditions and fast order execution. Furthermore, a comprehensive selection of products and services enables everyone to select the best option.

The licences of various regulators serve as evidence of the broker’s reliability. The company has more than ten years of work experience in the financial, trading, and other services markets. Hot Forex has won 35 important awards throughout that time. Meta Trader 4 and Meta Trader 5 trading terminals are employed for trading.

Pros

- FX Blue Labs created the Premium Trader Tools to improve the basic Meta Trader toolset.

- HFM has achieved a nice balance between its market research, information from outside sources, and news.

- An internal team generates monthly, weekly and annual outlooks among the specific research reports.

- Data on correlation and opinion can be found in the Traders Board module of HFM.

- With its updated HFM app, 1,200 markets can now be traded.

- As part of their Return on Free Margin (ROFM) service, recently introduced traders can earn up to 3% interest on the new margin in their accounts.

Cons:

- Terms of withdrawal may not always match those stated

- Due to the limited number of account currencies, some clients must pay for double conversion;

- The number of electronic payment methods available for withdrawal and refill is minimal

- Although registration is quite simple, you need help understanding the terms of other types of accounts while it is being processed; customer help is inaccessible on weekends.

User Experience with Hot Forex

Some aspects that work in this company’s favor are ease of use, a simple and well-designed website, and quick onboarding. The market-maker does not, however, now operate in the United States or Canada.

Hot Forex differentiates itself through its transparency and the caliber of the information it offers to new and experienced consumers. This covers a thorough analysis of the expenses, margin needs, and minimal deposits related to each account type and the abundance of trading knowledge offered on the website. A type of tradeable agreement, the CFD crypto serves the dual purposes of trading and protecting.

Hot Forex’s option to use Meta Trader instead of its original web-based trading platform is more than made up for by the latest trading tools it provides as an add-on to the well-liked trading programme. Features like integrated market news, buy and sell indications, charting, and technical analysis are welcome additions to the trading experience and provide investors of all skill levels with a definite advantage.

The broker’s support staff is available from 7:00 to 23:59, Monday through Friday, to address any unexpected circumstances or questions that crop up during trading. The used time zone is equal to GMT +2. Support is offered by email and live chat during non-business hours.

Market-leading insurance from HotForex

The company has taken extra precautions to protect its liabilities to clients and established an insurance programme with a €5,000,000 limit that includes industry-leading coverage against mistakes, omissions, carelessness, fraud, and several other risks that could result in financial loss.

HotForex: Market Maker or not?

The market maker license belongs to Hot forex broker. The Execution Venue shall quote the Client bid and ask prices when acting as a Market Maker under normal market circumstances. Without actually buying any Bitcoin, it is possible to take a position on whether it will increase or fall by using CFD crypto.

On HotForex, are demo accounts available?

Yes. Trading on the HotForex trial account gives users access to all markets, several technical indicators, and a real-time pricing display. Traders can use the demo account to practice trading strategies using the HFM, Meta Trader 4, and Meta Trader 5 tools in a risk-free setting.

HotForex – Does Scalping Allow?

No! They forbid scalping. In comparison to XM or Exness, HotForex does not offer cheap spreads. Instead, this broker organisation has incredibly low swaps and slippages.

Conclusion:

HotForex is appropriate for more discerning forex traders who live anywhere in the world and is one of the forex brokers with an excellent client reputation. Recently, HotForex changed its name to HF Markets. A fully licensed forex broker, HF Markets Ltd. is a part of the HF Group. Based on our excellent experience, we fully support HotForex.

Despite the numerous brokers that have popped up worldwide and who we have tested thus far, HotForex stands out, outperforms the norm, and ranks among the best!

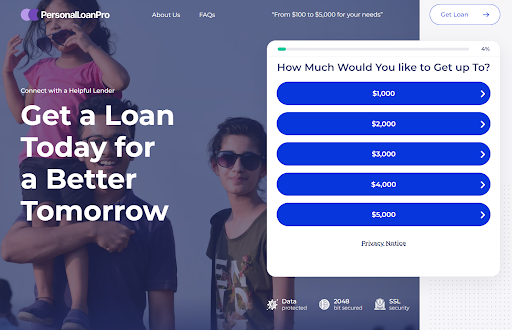

If you’re facing any financial issues, Personal Loan Pro is the best way that helps you to get a loan in an emergency. You can get a loan with the help of this platform at meager interest. You can get a loan for any emergency needs like a wedding ceremony, renovate a house, pay tuition fees, and any other emergency circumstances.

This unique website helps you learn how to get a loan and connects you with direct money lenders. Personal Loan Pros is the best way for citizens facing emergency problems and wanting to get rid of these problems. Customers get a loan within 24 hours.

What Makes Personal Loan Pro a Pro Solution?

Personal Loan Pro is a website that helps those customers who want to loan to fulfill their emergency needs. If you’re going to get a loan for any emergency, this website helps you a lot and offers you beneficial lenders.

If you want to get a loan, firstly, you visit this website online and fill out the loan application and fill out the application with your personal and professional information. When you fulfill the eligibility criteria, then you’re able to get a loan for emergency needs and your emergency crisis. If you want to borrow money by using this website, you must follow the instructions and guidelines given on this site, and then this website connects you to direct money lenders.

What Personal Loan Pro Can Offer You?

Personal Loan Pro offers you multiple supreme lenders. These money lenders provide you loans according to your will. Firstly, you can visit this website online and select why you want to get a loan.

Then you must fill out the loan form and complete all the requirements mentioned in the application. If you’re eligible for a loan, this website helps you connect with multiple money lenders.

After approving the application, money lenders provide you with a loan within 24 hours. Using this website, you can get a loan from $100 to $5,000. In addition, you can get loans with very low-interest rates. Click here to get a personal loan.

Moreover, It’s a massive benefit for the customers. They get the whole amount and then repay it quickly. This website is very beneficial for those citizens who don’t have enough money to handle emergencies.

The Process Of Getting A Loan From Personal Loan Pro

Personal loan pros cannot offer direct loans to their customers. In fact, this website connects customers to direct money lenders. From here, you can gather information and get the application form. Fill out this form. If you’re eligible for a loan, this website offers multiple money lenders. The process is straightforward to get the loan. Visit this website and get the loan application.

- Firstly, fill that option why you want to take a loan.

- Provide your full name, email, contact number, street, and house address.

- The necessary details contain all the information regarding your address, country, or state zip code.

- Fill in your employment status, which kind of job you have, have a part-time or full-time job, your own business, and whether you’re a student.

- Provide all the information that is necessary while filling out the application form. When you fill out the application, after approving the application, this website connects you to direct money lenders.

- Money lenders provide you loans within 24 hours. Personal Loan Pro is the best way to get loan information and offers help to its clients.

Factors Necessary For Getting A Loan From Personal Loan Pro

There are some basic requirements for borrowers. If you meet these prerequisites, you can fetch a loan from it.

- You must be an 18 years old mature person, if you want to get a loan.

- Have a valid identity and nationality proof.

- Also, you have a reliable primary source of income or any alternative source.

- Further, you must have an active bank account where you can get transactions.

Personal Loan Pro will connect you to authentic lenders on its platform if you fill all the requirements.

What Do Customers Like About Personal Loan Pro?

A ton of advantages to utilizing Personal Loan Pro are on the top of the list. After approving the application, this website offers you numerous valuable money lenders that can help you out in the process.

These money lenders provide you with loans with low-interest rates. Moreover, from this website, you can get a loan without any collateral. If you have insufficient credit, then you can even be competent to acquire a loan. You can get a loan according to your financial needs and repay it quickly with low interest.

You can get a loan for emergency needs on Personal Loan Pro with quick service. After approving the application, you can get a loan even within a day. The main benefit of this website is that you have lots of flexibility about getting the loan amount.

You can borrow a loan of up to $5000 without any hurdle by using the Personal Loan Pro website. Further, you can borrow the amount from a higher minimum to a maximum loan amount. Personal Loan Pro offers plenty of advantages for its customers.

Conclusion

In short, Personal Loan Pro offers multiple advantages to its customers and helps them how to get a loan. If you want a loan, this website is very beneficial for you, and you can get a loan from this site urgently.

After completing the application, please submit it on the Personal Loan Pro website. If you’re eligible for the loan, you can get a loan within a day. The application form mentions all the necessary criteria you must fill out.

The repayment policy is based on your source of income, loan purpose, why you want to get it, and where to use it. When your application is approved, this website offers you worthy lenders. Therefore, Personal Loan Pro is the best choice for you if you want to get a loan in emergencies.

Startups

- The Top 6 Work from Home Careers

- The Best Advice You Could Ever Get About Enough Already! 15 Things About The Intermediate Guide to greg reyes We’re Tired of Hearing

- Watch Out: How michael spencer Is Taking Over and What to Do About It

- 10 Startups That’ll Change the hough uf Industry for the Better

- 10 Startups That’ll Change the linda jackson Industry for the Better

Categories

Business

-

blog3 years ago

blog3 years agoThe Ultimate Cheat Sheet on 17 Reasons Why You Should Ignore hulk hogan death

-

Technology2 years ago

Technology2 years agoFollow a consistent cadence towards Google algorithms – applepie’s blog

-

Startups2 years ago

Startups2 years agoThe Top 6 Work from Home Careers

-

blog3 years ago

Become an Expert on lou pai by Watching These 5 Videos

-

blog7 months ago

blog7 months agoKeeping Things Flowing: The Importance of Drain Cleaning Services

-

blog2 years ago

blog2 years agoThe 13 Best Pinterest Boards for Learning About aib college of business

-

blog2 years ago

blog2 years agoWhat the Oxford English Dictionary Doesn’t Tell You About 7 Answers to the Most Frequently Asked Questions About thomas spencer

-

blog2 years ago

blog2 years agoWatch Out: How michael spencer Is Taking Over and What to Do About It